Groceries at the Heart of NEXT’s Investment Strategy

Europe’s grocery sector represents one of the most resilient, essential, and consistent performing areas of real estate investment. Driven by everyday consumer needs, grocery retail provides a recession-proof investment opportunity.

€1 trillion in grocery sales across Europe (2024)

Brick-and-mortar is dominant as grocery shoppers prefer to shop in-store

Long-term CPI-linked leases with Europe’s top supermarket chains

Protected asset value due to high barriers to entry for new competition

NEXT’s Investment Zones

NEXT’s investment zones are designed to enhance, protect, and future-proof the fund’s grocery-anchored assets, ensuring they remain resilient, income-generating, and attractive to tenants over the long term.

Our Real Estate Portfolio

Investor returns are underpinned by a real estate portfolio anchored by some of Europe’s most dominant grocery retailers.

As of Q1 2025, including indirect holdings via SCPI GMA Essentialis

Fund Overview

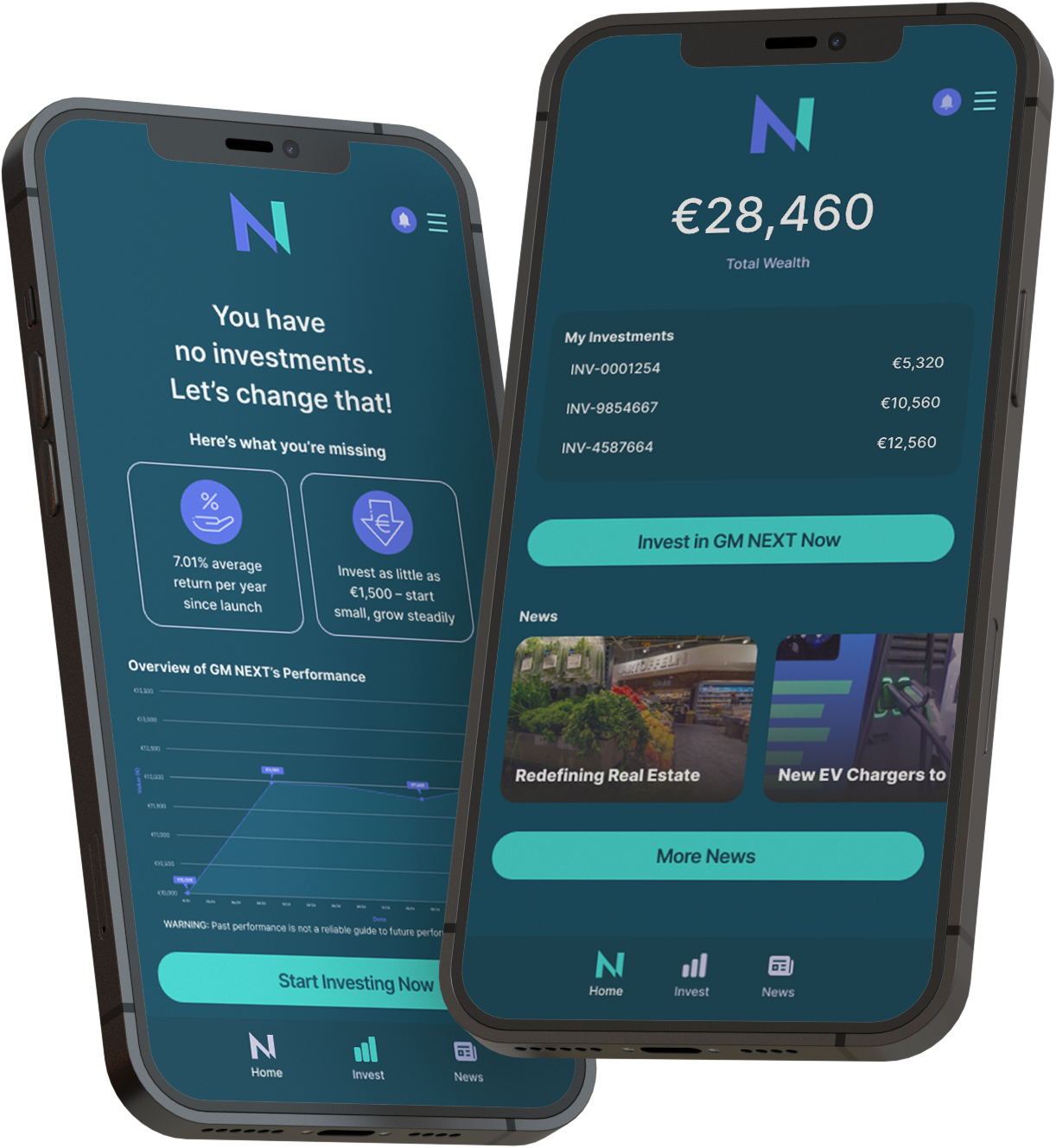

Greenman NEXT is a Luxembourg-based open-ended European Long-Term Investment Fund (ELTIF), launched in 2021, that focuses on grocery-anchored real estate investments across Europe. It aims to provide investors with stable income and long-term growth by anchoring their portfolios in one of Europe’s most resilient asset classes.

Structured for long-term sustainable growth, NEXT is classified as an SFDR Article 9 sustainable investment fund.

Key Fund Details:

- Open to all types of investors

- Quarterly subscription and redemption opportunities

- Minimum investment: €1,500

- Target annual return: 7–9% (based on minimum 5.5-year investment horizon)

- Max LTV on real estate assets: 85%

SFDR Disclosures

How Greenman, OPEN’s AIFM, considers PAI on sustainability factors in the investment decision-making as well as other sustainability disclosure requirements.

Principle Adverse Impacts Disclosure

Website Disclosure

Remuneration Disclosure